An emergency fund is a cornerstone of financial security, yet many people are surprisingly unprepared for unexpected events. Facing a sudden job loss, medical crisis, or home repair, without a financial safety net can lead to significant hardship and stress. This comprehensive guide will delve into the reasons behind this unpreparedness and offer concrete steps on how to build a robust emergency fund, equipping you to handle unforeseen circumstances with confidence.

Understanding the Lack of Preparedness

Many individuals find themselves vulnerable to financial emergencies due to a variety of interconnected factors. One prominent reason is the persistent pressure of everyday expenses, which often leave little room for saving. Many individuals struggle with maintaining a consistent budget and often find their incomes barely meeting expenses, making saving for an emergency fund extremely challenging. Additionally, unexpected expenses and lack of financial literacy often act as barriers to building a safety net.

The Burden of Everyday Expenses

The relentless demands of daily life—housing, food, transportation, utilities—often leave little disposable income, let alone savings for an emergency. High living costs in certain areas further exacerbate the problem, creating a vicious cycle where individuals constantly struggle to make ends meet. For example, a single parent working a minimum-wage job in a high-cost city might struggle to allocate enough funds for even the most basic savings plan, thereby undermining their emergency preparedness.

Unforeseen Expenses and Financial Literacy

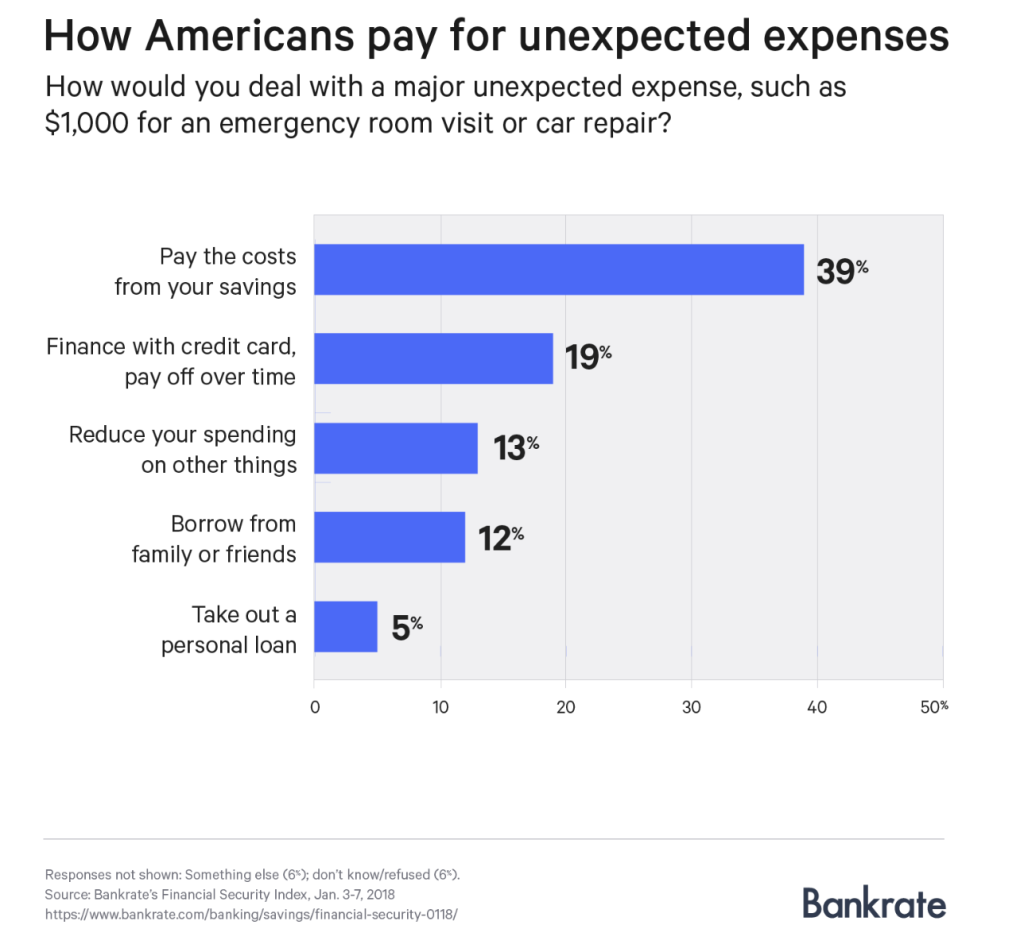

Unforeseen expenses, such as major home repairs, medical emergencies, or car breakdowns, can quickly deplete even the most diligently saved funds. Without a financial safety net, individuals may resort to high-interest debt, further compounding the situation. Lack of financial literacy plays a significant role in this problem, as many are simply unaware of the importance of having an emergency fund. Without clear strategies for handling various financial situations, unpreparedness can stem from the lack of these crucial financial skills.

Crafting Your Emergency Fund Strategy

Building an emergency fund requires a structured approach that aligns with individual circumstances. First and foremost, a thorough budget is essential. This allows you to identify areas where you can cut costs and allocate more funds for savings. Setting realistic savings goals, even small amounts initially, is crucial for consistency. Consider using savings accounts with high-interest rates to maximize your return on investment.

Prioritizing Savings and Utilizing Tools

To establish a robust emergency fund, prioritize regular savings. Automate transfers from your checking to your savings account each month, even if it’s just a small amount. Explore high-yield savings accounts or certificate of deposit (CD) options to enhance your return on investment. These tools can provide a more effective approach to saving, ensuring your funds grow over time.

How do I create a budget that accommodates saving?

Creating a budget that allows for savings involves careful tracking of income and expenses. Identify areas where you can cut back on spending, such as discretionary purchases or subscriptions. Look for ways to reduce unnecessary expenses. Prioritizing savings while managing everyday expenses effectively is crucial for financial wellness.

How can I create a realistic savings plan?

Creating a realistic savings plan involves setting achievable goals, even if they seem small at first. Start with a minimum amount and gradually increase it over time. Break down larger goals into smaller, more manageable milestones, increasing savings gradually as you get more comfortable with budgeting. The key is consistency over time.

What financial tools can help in building an emergency fund?

Various financial tools can assist in building an emergency fund. High-yield savings accounts, CDs, and other investment options allow your funds to accrue interest. Online budgeting tools can help automate and monitor savings progress. Consider using budgeting tools to help track spending and identify areas for potential savings.

Are there any psychological strategies for saving for emergencies?

Adopting psychological strategies can help maintain consistency in saving. Link savings to positive goals rather than solely focusing on avoidance. Visualize the benefits of having an emergency fund as a source of peace of mind and financial security. Positive reinforcement, through clear visualization and reward-based systems, encourages long-term commitment.

Frequently Asked Questions

What is the ideal amount for an emergency fund?

The ideal amount for an emergency fund varies based on individual circumstances, but a common guideline is to aim for three to six months of essential living expenses. This amount can mitigate the immediate financial impact of job loss or other significant disruptions. The three- to six-month target provides a buffer against potential financial hardships.

In summary, financial unpreparedness for emergencies is a widespread issue stemming from various factors. Building an emergency fund is crucial for mitigating risks and ensuring financial stability. This article has outlined several key strategies, including budgeting, saving consistently, and utilizing various financial tools. By diligently following these steps, you can confidently navigate unforeseen circumstances and achieve financial security. Now, take action and start building your emergency fund today! You can begin by creating a detailed budget, setting realistic savings goals, and exploring suitable financial tools for your situation.