How to Deal with Financial Setbacks and Keep Your Personal Finances on Track

Unexpected financial setbacks can significantly impact your well-being and disrupt your financial plans. Whether it’s a job loss, a medical emergency, or unexpected expenses, maintaining a stable financial future requires proactive strategies for managing these challenges. This comprehensive guide will explore practical steps and actionable insights for dealing with financial setbacks and keeping your personal finances on track. We’ll delve into crucial aspects such as budgeting, emergency fund creation, debt management, and exploring alternative income streams. This article will be structured around these key areas to provide a holistic approach to financial recovery.

The guide is organized into sections covering budgeting, creating an emergency fund, managing debts, and exploring alternative income strategies, culminating in a detailed conclusion.

Understanding and Acknowledging the Setback

Recognizing the Impact of Setbacks

Financial setbacks, such as job loss or unexpected medical expenses, can significantly impact an individual’s financial well-being. These events often lead to feelings of stress, anxiety, and uncertainty about the future. Acknowledging the setback is the first crucial step in developing a sustainable financial recovery plan. Don’t ignore the problem, but rather address it head-on with a plan.

Assessing the Extent of the Problem

Carefully assess the severity of the financial setback. How much money is lost or needed, and what are the immediate and long-term implications? This step helps in realistically evaluating the situation and formulating effective strategies for managing the losses and mitigating their effects.

Prioritizing Needs Over Wants

Understanding the difference between needs and wants is vital. Categorize expenses into essential needs (housing, food, utilities) and non-essential wants (entertainment, dining out). Prioritize needs and make adjustments to non-essential spending to allocate more resources to essentials during a crisis.

Building a Budget for Stability

Creating a Realistic Budget

A crucial step in stabilizing your finances is creating a realistic budget. Detailed budgeting allows you to track income and expenses, identify areas where spending can be reduced, and allocate funds effectively to your needs and goals. Thorough record-keeping is important.

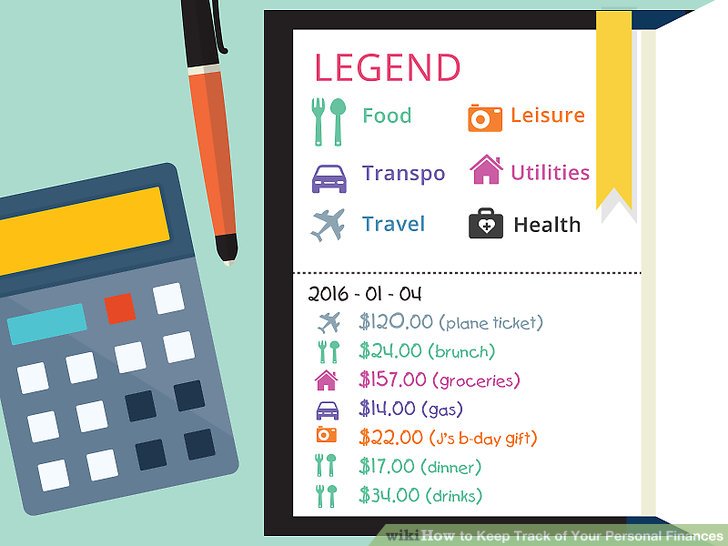

Tracking Income and Expenses

Accurately record all income sources and expenses. Use budgeting apps or spreadsheets to track your spending, categorize expenses, and identify patterns. Reviewing your spending habits for a clearer picture of spending patterns is beneficial.

Identifying Areas for Cost Savings

Once you understand your spending habits, identify areas where you can cut costs without compromising your essential needs. Consider reducing discretionary spending, negotiating bills, or finding cheaper alternatives for services.

Establishing an Emergency Fund

The Importance of Emergency Funds

Building an emergency fund is an essential step in financial preparedness. An emergency fund provides a safety net during unforeseen circumstances. It offers a sense of security and allows you to handle unexpected financial shocks without incurring debt.

Strategies for Building an Emergency Fund

Allocate a portion of your income towards an emergency fund. Create a savings plan and gradually increase the amount saved over time. Consider automated transfers to your savings account to maintain consistency.

Linking Emergency Fund to Financial Goals

A well-established emergency fund can further aid in achieving financial goals. It provides financial security and allows you to pursue other financial opportunities without fear or worry.

Managing Debt Effectively

Understanding Different Types of Debt

Debt comes in various forms, from credit card debt to personal loans. Understanding the different types of debt and their associated interest rates is essential for developing a strategy for repayment.

Strategies for Debt Repayment

Utilize various debt management strategies like the debt snowball method or the debt avalanche method to strategically reduce your debt burden. Prioritize high-interest debt or consider debt consolidation options to simplify your repayment plan.

Avoiding Debt Traps

Recognize and avoid high-interest loans or predatory lending practices that can lead to mounting debt. Exercise caution when seeking loans or credit to safeguard your financial well-being.

Exploring Alternative Income Streams

Identifying Potential Income Sources

Exploring alternative income streams can provide additional financial resources to deal with setbacks. This might include freelancing, selling unused items, or finding part-time gigs.

Leveraging Existing Skills

Identify skills or talents you possess that can be monetized. Freelancing, online tutoring, or offering specialized services can generate additional income to offset financial losses.

Seeking Support and Resources

Seek guidance from financial advisors, counselors, or support groups to explore various strategies and resources to bolster your financial well-being.

In conclusion, navigating financial setbacks requires a proactive and multifaceted approach. Understanding your spending habits, developing a budget, and exploring alternative income streams are crucial steps in regaining control and stability. By focusing on long-term financial health, you can effectively overcome challenges and build a stronger financial foundation for the future. Take the next step today and start planning your financial recovery. Visit our website for more resources and support!