Financial stress is a common experience, affecting individuals and families worldwide. It can stem from various sources, such as debt, unexpected expenses, or simply the feeling of being overwhelmed by financial responsibilities. Overcoming financial stress and charting a course towards financial independence requires a proactive approach, a well-defined plan, and consistent effort. This comprehensive guide will equip you with the knowledge and tools to navigate your financial challenges and build a strong foundation for your future. This article will walk you through several key areas, including understanding financial stress, developing a budget, building an emergency fund, and strategically planning for retirement. It will also delve into the nuances of debt management and smart investment strategies.

Understanding Financial Stress and Its Impact

The Root Causes of Financial Stress

Financial stress isn’t just about the numbers; it’s a complex emotional experience. Stress can arise from a variety of sources. Unforeseen medical emergencies, job loss, or even major life changes such as a child’s education expenses can create significant financial stress. Feeling trapped by debt, the constant pressure to meet monthly expenses, or the fear of running out of money are also major sources of stress. These factors often contribute to anxiety, depression, and other mental health issues. The pressure to maintain a certain lifestyle or keep up with societal expectations also adds to this weight. Understanding these triggers can help you develop targeted solutions.

Identifying Your Financial Stressors

Recognizing the specific factors contributing to your financial stress is crucial. Are you overwhelmed by mounting credit card debt? Are unexpected home repairs creating financial strain? Or perhaps the constant pressure to achieve a certain lifestyle is causing financial worries? Keeping a detailed financial journal to track your income, expenses, and debts can help you identify patterns and pinpoint your financial pain points. This knowledge is the first step to creating a personalized and effective solution to your financial stress.

Creating a Realistic Budget

The Importance of Budgeting

Effective budgeting is a cornerstone of financial stability. It’s essentially a financial roadmap that guides your spending habits and helps you align your spending with your goals. A detailed budget helps you track your income and expenses, enabling you to allocate resources effectively and prevent overspending. By knowing where your money goes, you can make informed decisions and prioritize saving for important goals.

Practical Budgeting Techniques

There are several techniques to effectively manage your budget. The 50/30/20 rule, for example, suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This method is a good starting point, but you can customize it to your specific needs and circumstances. Create a detailed list of all your income sources, categorize your expenses into essential needs and wants, and prioritize debt repayment if applicable.

Building an Emergency Fund

The Significance of Preparedness

Having an emergency fund is crucial for financial stability. This fund provides a safety net for unexpected expenses such as car repairs, medical emergencies, or job loss. A well-maintained emergency fund acts as a buffer against unexpected financial shocks, preventing you from falling into debt and allowing you to maintain financial independence.

Strategies for Building an Emergency Fund

Aim to have at least 3-6 months of living expenses saved in an easily accessible emergency fund. Gradually increase your contributions. Automate savings by setting up recurring transfers from your checking to your emergency fund account. Look for high-yield savings accounts or certificates of deposit to maximize your returns. Prioritizing this fund will protect you during unforeseen circumstances.

Managing Debt Effectively

Understanding Different Types of Debt

Debt can be a significant source of financial stress. Understanding the different types of debt and their impact on your financial situation is important. Credit card debt, student loans, mortgages, and personal loans each have unique characteristics and repayment strategies. High-interest debt, such as credit card debt, often increases your overall debt burden and requires strategic repayment plans.

Creating a Debt Repayment Plan

Develop a detailed debt repayment strategy. The snowball method involves paying off the smallest debts first to build momentum, while the avalanche method prioritizes high-interest debts first to save money over time. Consider debt consolidation options if appropriate to simplify payments and potentially lower interest rates.

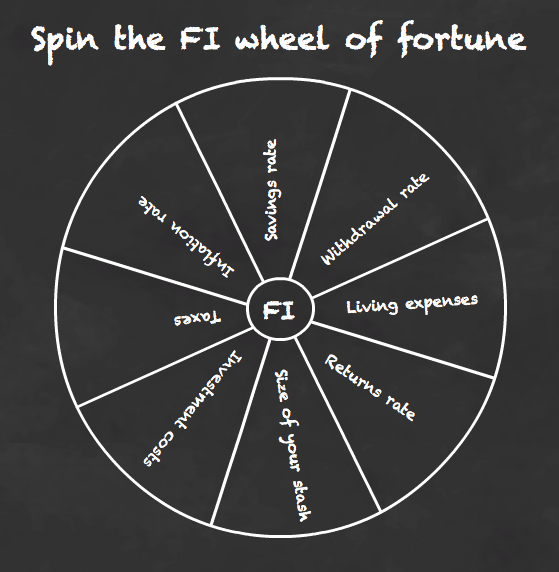

Planning for Financial Independence

Setting Realistic Goals

Financial independence is a journey, not a destination. Setting realistic goals and milestones is crucial for success. Identify short-term and long-term financial goals. Whether it’s buying a house, funding your children’s education, or retiring comfortably, these goals will motivate your financial planning and give you something to strive for. This will serve as a roadmap for all your financial decisions.

Investing for Long-Term Growth

Long-term investment strategies are essential for building wealth. Diversify your investments to mitigate risk and maximize returns. Consider a mix of stocks, bonds, mutual funds, or real estate to spread your investments and take advantage of potential gains while mitigating potential loss.

In conclusion, managing financial stress and achieving financial independence is a journey, not a destination. By developing a comprehensive plan, consistently practicing budgeting and saving, and seeking professional financial advice when needed, you can build a strong financial foundation for the future. Remember, financial literacy is key, and with dedication and consistent effort, you can gain control of your finances and unlock your path to financial independence. Take the first step today—start creating your personalized plan and work towards a brighter financial future! Contact a financial advisor for personalized guidance.