Building a diversified investment portfolio is paramount for long-term financial security. However, many individuals face challenges in creating such a portfolio, leading to missed opportunities and potential financial setbacks. This article delves into the reasons why people struggle to diversify their investments and provides actionable strategies for building a robust investment portfolio. We’ll explore common pitfalls, offer practical solutions, and provide a clear roadmap. This article will be structured to outline common obstacles, explore solutions for each, and provide a concrete example to demonstrate application. Throughout, we’ll use real-world examples and data to reinforce these concepts and support our arguments.

Understanding the Pitfalls of Inadequate Diversification

Lack of diversification in investment portfolios often stems from a blend of misconceptions and practical obstacles. Many investors fail to understand the fundamental importance of spreading their investments across different asset classes. This lack of understanding can result in significant financial losses during economic downturns. For instance, a portfolio heavily reliant on a single stock could face substantial losses if that stock’s value declines sharply. Furthermore, some investors prioritize short-term gains over long-term security, leading them to make impulsive investment decisions that can harm the overall performance of their portfolio. They may miss out on the crucial benefits of diversification by focusing on immediate returns.

The Role of Emotional Factors in Investment Decisions

Fear and Greed in Investment

Investors are not always rational; emotions like fear and greed often play a significant role in their investment decisions. Fear of loss can lead to panic selling, particularly during market downturns, resulting in missed opportunities to recover lost value. Conversely, greed can lead investors to overexpose themselves to risky assets, ignoring the importance of diversification and potentially leading to significant losses. A lack of knowledge about financial markets can exacerbate these emotional responses, causing investors to react impulsively rather than using a well-thought-out strategy.

Impulsive Decision-Making

Impulsive decisions can significantly affect portfolio performance. Individuals may chase high-yielding investments without assessing the underlying risks. Without proper understanding and diversification strategies, this can rapidly erode the value of a portfolio and derail investment goals.

Overcoming the Knowledge Gap

Recognizing the Importance of Professional Advice

Navigating the complexities of the investment world requires a sound understanding of various financial instruments, markets, and economic factors. Many people lack this comprehensive understanding and fail to seek professional advice from financial advisors. Financial advisors provide valuable insights into market trends, asset allocation strategies, and risk tolerance assessments to help build a diversified portfolio. They offer valuable perspectives that go beyond the individual investor’s personal bias and provide a balanced approach based on comprehensive market analysis.

The Power of a Well-Structured Portfolio

Building a Diversified Asset Allocation

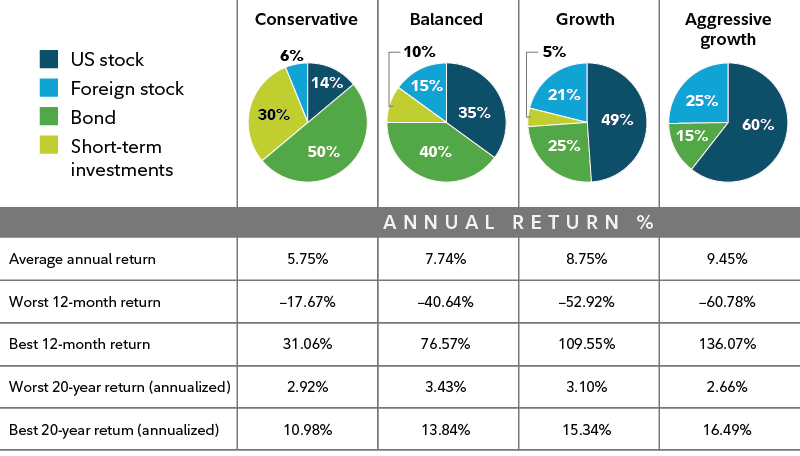

A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and other asset classes. This balanced approach mitigates risk by spreading investments across different sectors and market conditions. For instance, stocks often offer higher potential returns but come with higher risk, whereas bonds generally provide more stable returns with lower risk. A balanced approach ensures that the portfolio is resilient to market fluctuations and maintains a healthy return over time.

Implementing a Disciplined Investment Strategy

Establishing Clear Financial Goals

Establishing clear financial goals is a crucial part of successful investment. Whether it’s retirement savings, buying a home, or funding a child’s education, knowing your goals helps shape your investment strategy. A diversified portfolio is tailor-made to support long-term goals while managing short-term fluctuations. This discipline is essential for staying focused on the ultimate objective.

How can I create a diversified investment portfolio that aligns with my financial goals?

Building a diversified investment portfolio that aligns with your financial goals requires a structured approach. First, identify your financial objectives and risk tolerance. Next, allocate your investments across different asset classes, including stocks, bonds, real estate, and potentially other alternatives. Establish a clear investment strategy and a regular review process to adjust to market shifts and changing needs. Consulting with a qualified financial advisor can provide personalized recommendations and help tailor the portfolio to your unique circumstances.

Frequently Asked Questions

What are the common reasons why people fail to build a diversified investment portfolio?

Many people fail to create a diversified investment portfolio due to a combination of emotional factors, lack of knowledge, and a reluctance to seek professional advice. Fear and greed are often significant hurdles, as are impulsive decisions and a lack of awareness of different asset classes. Misconceptions about investment strategies, coupled with a lack of thorough research and analysis, further contribute to this issue. It’s crucial to address these factors proactively and seek guidance to build a strong portfolio.

In conclusion, constructing a diversified investment portfolio is crucial for long-term financial success. Understanding the common pitfalls, actively seeking professional guidance, and embracing a disciplined approach are key. By implementing these strategies, you can significantly enhance your chances of achieving your financial goals while mitigating risks. Ready to build your diversified portfolio? Let’s discuss your financial aspirations and create a roadmap to get you there! Contact us today for a free consultation.